Yet, it’s important to include the necessary expenses that are needed to ensure the business stays on track in the future. Base budgets tend to focus on ongoing operating costs instead of focusing on short-term projects. And it can be for a single person, a business, or individual departments within a company. Stashing https://www.intuit-payroll.org/ 10% of your income into your savings account is daunting or impossible when you’re living paycheck to paycheck. It doesn’t make sense to have $100 in a savings plan if you are fending off debt collectors. With a proper emergency fund, you will not need your credit card to keep you afloat when something goes wrong.

Can Keep You from Overspending

A budgeting app can take some of the manual work out of budgeting. These apps can track your spending, categorize expenses, and alert you when you’re close to exceeding your budget. Investing involves putting money into an account where you can invest in securities like stocks, bonds, and exchange-traded funds (ETFs).

Budgeting Can Help You Fix Bad Spending Habits

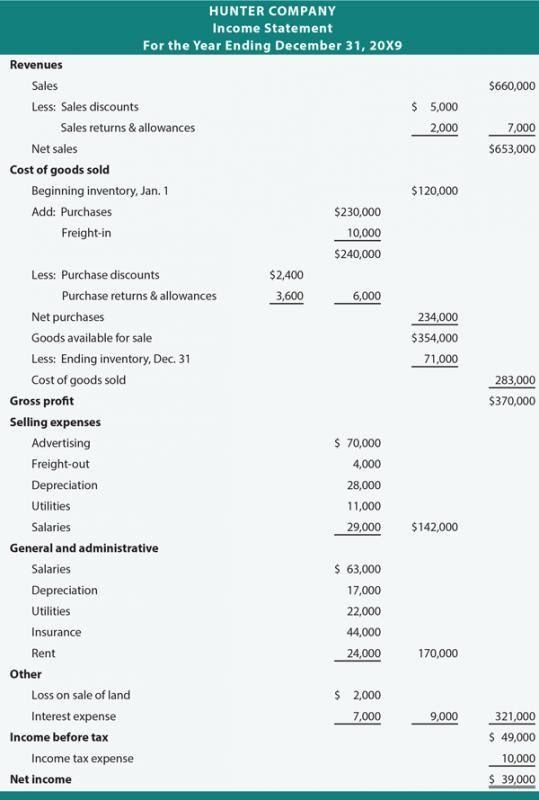

Additionally, budgeting helps in identifying any inefficiencies in the financial processes and operations that need to be addressed to reduce costs and increase profitability. The budgeting process for most large companies usually begins four to six months before the start of the financial year, while some may take an entire fiscal year to complete. Most organizations set budgets and undertake variance analysis on a monthly basis.

How Does Budgeting Help a Business?

Budgeting apps, such as YNAB, provide tools for setting up an emergency fund, depending on your chosen approach. It is one of the crucial financial planning tools as it helps organizations set goals by analyzing the various sources of income, expenses, and savings target. This makes it easier for the organizations to understand their financial viability and allocate resources. Whether you are a small or large business, budgeting is a way to gain control over your finances. When you sit down to make your budget, first address the fixed expenses.

Get Over the Terminology

The other portion goes toward your cash value, which grows your policy based on a set interest rate. Since term life coverage eventually expires, insurance companies sell it at a significantly cheaper premium than whole life insurance. The average monthly cost of insurance for a 20-year term life policy with a $500,000 death benefit is $26 (for a 30-year-old male and female with a few health conditions).

Savings and investments

You’ve probably heard this referred to as “keeping up with the Jones’”, and it’s a bad (and financially dangerous) way to live. Financial contentment is one of the foundational elements of good financial behavior. It keeps you from spending money that you don’t have, and helps you to enjoy your financial journey. I think it’s pretty common knowledge that money fights tend to be one of the biggest problems in marriage. So, if you want to end the financial fights between you and your spouse, and finally get on the same financial page, then budgeting is a critically important first step.

Stash101 is not an investment adviser and is distinct from Stash RIA. Dunn knows your margin is affected by life circumstances, “But once you’ve got a margin, fight like crazy to keep it.” In other words, don’t let lifestyle creep eat away at that buffer. Before selecting the best way, you need to test out several different approaches.

If you don’t save up for anything big, you may not be able to afford this change in your living situation down the road. A budget is a microeconomic concept that reveals the trade-off made when one good is exchanged for another. These principles hold true whether the budget is intended for an individual, a family, or a company. Kirsten VerHaar is an editor for personal finance, with an English literature degree from the University of Colorado Boulder. In her previous roles, she was a lead editor with eBay, where she managed a team of writers who produced coverage for the site’s global content team. Since joining NerdWallet in 2015, she has covered topics as wide-ranging as vacuums (yes, really), budgeting and Black Friday.

These adjustments can be small changes that are designed to improve efficiency, reduce costs, or increase revenue. The kaizen approach involves continuous monitoring of the budget and making adjustments as needed. This ensures that the company is always moving towards its financial goals. Top-down budgeting is a budgeting process that starts at the top of the organization coupon rate vs yield to maturity and works its way down. This approach to budgeting is typically used in large organizations where the budget is created by top-level management and then allocated to lower-level departments. Evaluating performance is a crucial step in budgeting, as it allows individuals and organizations to determine whether they have achieved their goals and objectives.

Developing a Plan is a crucial step in the budgeting process as it helps to establish a clear roadmap for achieving financial goals. This involves outlining specific actions and strategies that will be implemented to manage finances effectively. In conclusion, effective forecasting is an essential component in the budgeting process, enabling individuals and organizations to achieve their financial goals and objectives.

- Expenses are everything you spend money on each month, including necessities like rent and groceries, as well as discretionary spending such as entertainment or shopping for fun.

- Savings typically refer to money set aside in easily accessible accounts, like high-yield savings accounts or certificates of deposit (CDs).

- Here are the basics on why budgeting is important and how to get started.

- For example, if you’re out of money, the entertainment budget takes a hit, and you stay home on Friday night, or you don’t buy those new shoes that you’ve been considering.

Part of taking control of your money is learning how to exercise some discipline in your spending habits. Part of America’s aversion to budgeting may be rooted in language. The word “budget”—much like the word “diet”—has negative connotations. Budgets and diets are viewed as restrictive reminders of things we cannot have. If the tools are used properly, they lead to the desired outcome. Nobody dislikes the word “shovel,” even though the use of the shovel requires effort.

Technology is instrumental in helping a company organize a budget. You can analyze trends and generate forecasts quickly and accurately. Business management software is an essential tool in making a realistic data-based budget. You get more organized by sitting and thinking out, and planning your expenditure. To save money, you start planning expenses and selecting vendors carefully.

Knowing where your money is being spent and how much you have left for the month can keep you on track with your expenses. By keeping track of your budget, you can also prevent yourself from https://www.accountingcoaching.online/five-basic-elements-of-accounting-for-any-business/ overspending and you’ll always know where you stand financially. The purpose of a budget may differ for everyone, but in most cases, you’ll use this plan to reach specific financial goals.

That includes your regular paycheck as well as funds from any other sources. You’ll need to understand your monthly income so you can plan how to spend and save your money. While everyone’s financial situation is a bit different, most budgets contain four core components. You’ll want to consider each of these when making a monthly budget in order to manage your money effectively.