As well, there is an awful feeling to the decentralization from Ethereum when the transfers control 1000s of validators. Staking cryptocurrencies is just one of the easiest and most predictable means discover rewarded from the crypto place. During the Kiln, i only service method staking, where slashing is among the dangers you’ll need to worry about. All of the PoS protocols trust circle involvement and you may validator ethics so it is critical to select the right staking-as-a-supplier. Validators take part in the brand new network to own validating purchases and doing consensus, subsequently getting benefits in the way of ETH for their benefits to your blockchain. This permits believers and you can a lot of time-identity holders out of ETH so you can accrue perks and you may take advantage of the potential enough time-identity rate appreciate of ETH.

Ahead of We delve into Ethereum staking, why don’t we basic get a brief take a look at Ethereum’s go to a good proof-of-risk (PoS) opinion. For many who’lso are looking for cryptocurrencies besides Ethereum, here are a few all of our list of an informed cryptocurrencies to shop for proper today. Solamente staking comes to starting your own Ethereum validator and keeping it oneself.

- To get the best you’ll be able to experience delight make use of the most recent version out of Chrome, Firefox, Safari, otherwise Microsoft Border to view this site.

- This may lead to an issue if your change shuts down or closes its staking procedures.

- Ankr supporting multiple tokens including ETH, MATIC and you may Mark, as well as others.

- Staking while the a support enables you to outsource the newest staking techniques in order to a third-party merchant, definition you can earn rewards rather than dealing with the validator node.

- Meaning if the plenty of validators should withdraw the risk immediately, they could waiting some time regarding the log off queue.

Including, you could potentially risk your own Ethereum to the Binance, that is a strong alternative because you should be able to keep exchangeability as a result of BETH, a good token you to represents ETH gamble as a result of Binance. Complete, staking swimming pools are a great option for anyone who’s seeking to secure Ethereum staking advantages however, features below 32 ETH to help you stake. They give a means for individuals to help you work together to satisfy the fresh minimal draw of 32 ETH required to be a good validator. Involved perks is following divided specialist-rata among pool participants. Advantages are supplied to own tips that help the brand new network reach consensus.

Moonswap | Ethereum

Staking is the moonswap work of placing 32 ETH to interact validator app. While the a good validator your’ll be the cause of storage space research, processing purchases, and you can incorporating the fresh blocks to your blockchain. This can continue Ethereum safer for everyone and you will get you the new ETH in the process. Staking reduces the new hindrance to entry for doing the newest Ethereum network’s consensus procedure. Unlike exploration, and therefore expected official equipment and technical possibilities, staking can help you from the you aren’t a keen Ethereum bag and you may some ETH tokens.

You should note that the newest combine doesn’t ensure it is most recent validators to withdraw the gamble ETH. Withdrawing will simply end up being you can while the Shanghai inform is carried out later on. To stake ETH yourself, you desire a minimum of 32 ETH (already more than 40,100 USD) and loyal tools powering around the clock, rather than recovery time.

In the course of composing, more 30percent of all of the gamble ETH has been gamble because of Lido. You could care for infant custody of one’s possessions (i.elizabeth., the new crypto assets/ electronic assets your published and you can accumulated rewards) because of one purse or custodian service of your choice. Kiln’s staking platform try low-custodial, merely you have access to their assets by managing the fundamental purse which holds a claim to the funds.

Precisely what does Kiln charge because of its characteristics?

Turning to the top Ethereum staking swimming pools could be the best choice unless of course, of course, you may have a gap burning-in your own pocket. The fresh Do-it-yourself strategy entails setting up their validator node, which is a love way of claiming installing your server. Although this method may seem appropriate to Ethereum purists, there are several complications with which.

Ethereum staking opens up fun options and you can perks, but simply you’ve got the power to manage the manner in which you accrue them. Only there is the power to risk ETH but you come across fit; for the reason that it’s just what genuine mind-custody concerns. Your first choice is securely and you may easily financing a great validator Kiln.

Although not, solamente staking and you will staking while the a service is restricted to the individuals that have at the least 32 ETH. In the Kiln, i capture shelter very definitely and now we go after closely per supported protocol and make sure our customers are constantly high tech regarding process enhancements and protection recommendations. Please follow this link for more information on the our very own shelter infrastructure. Selecting the most appropriate company try an elaborate decision that really needs individuals considerations. During the Kiln, the surgery are determined by an excellent tripod worth system from precision, compliance, and you may assistance.

Profiles discover Universal ETH (uniETH) tokens because of the staking ETH for the Bedrock. That it token is AML controls certified, separate and verifiable, skillfully treated and you can agnostic to help you both central and you will decentralized transfers. Crafted that have a focus on the type of conditions away from organization clients, the platform in addition to caters to the needs of the newest merchandising industry. ETH h2o staking offers an apr of step 3.26percent, when you’re you to definitely to have node staking try 7.10percent. Lido can be applied a 10percent percentage to your staking rewards which can be separated between node operators plus the DAO Treasury.

It’s the work out of placing Ether (ETH), the newest indigenous money of one’s Ethereum blockchain, to Ethereum itself to assist make the brand new stops. Ahead of the Shapella Inform, people who guess ETH to your Ethereum couldn’t withdraw their ETH because are locked-up on the blockchain. Of a lot larger cryptocurrency transfers, such as Kraken and Binance.Us, and you may businesses provide Ethereum pooling has. For the time being, believe viewing the wallets webpage, where you could start learning to bring real possession over your money. As you prepare, return and you may peak your staking online game from the trying to you to definitely of the self-custody pooled staking features considering.

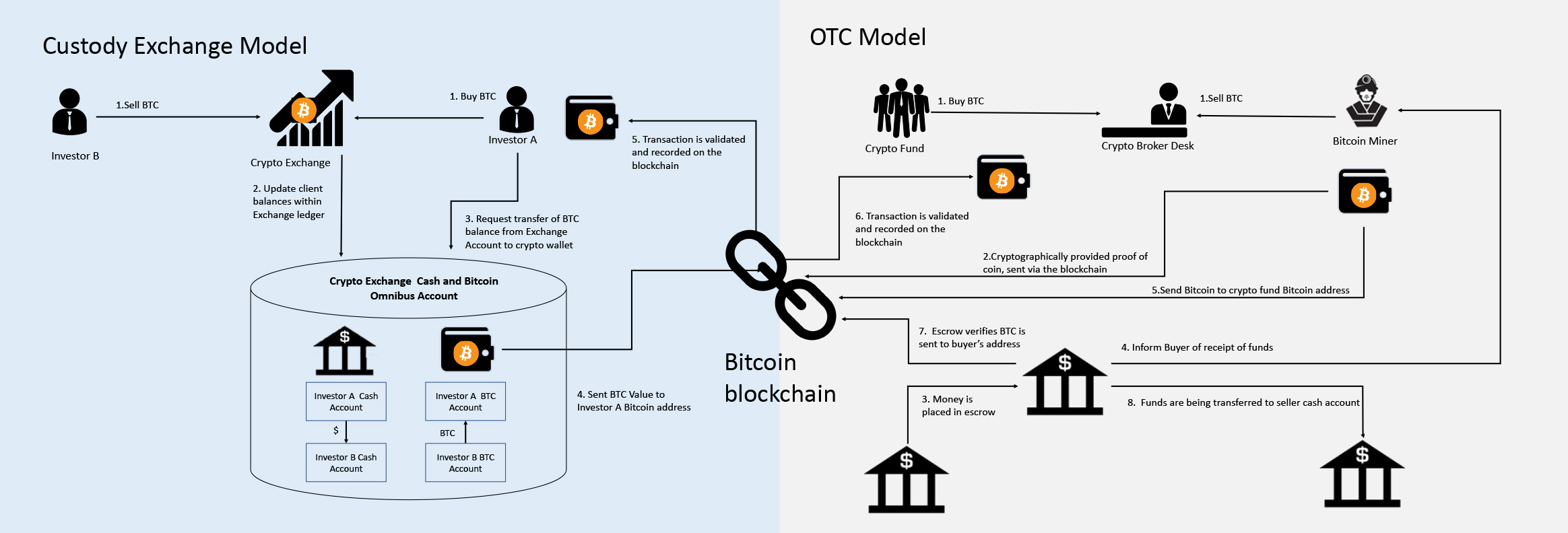

Until affiliate words identify if not, investors which have cryptocurrency possessions commingled for the a custodial cryptocurrency replace you are going to possibly eliminate their money as the unsecured financial institutions. Slashing are a severe penalty where a validator is removed completely in the Ethereum community and you can will lose the gamble ETH. Now you know all about how exactly staking deals with Ethereum, what about staking ETH yourself?

Some top cryptocurrencies you to implement facts-of-functions habits—particularly Bitcoin—have drawn widespread criticism because of their quickly expanding times consumption. The worth of crypto can also be change and you may money involved in an excellent crypto transaction try at the mercy of business volatility and you will losses. Stakers try able to withdraw their advantages and you will/or idea deposit off their validator balance when they choose. Numerous pooling possibilities today exist to aid pages that do perhaps not features otherwise feel comfortable staking 32 ETH. It provides complete involvement advantages, enhances the decentralization of the circle, rather than needs believing anybody else with your fund.

Decentralized crypto transfers tend to be Lido Money, Skyrocket Pond, and you will StakerDAO. Crypto wallets comprise sensuous wallets and you can cool purses you need to include of many of your brands powering better exchanges, Ledger, Trezor, and you may KeepKey. Once you have a wallet or a move membership, you can transfer ETH in order to they to begin with staking. Ethereum (ETH) is the 2nd-biggest cryptocurrency by industry cover once Bitcoin. Has just, Ethereum changed their consensus system to allow people to participate in staking, the whole process of securing right up ETH tokens to aid secure the Ethereum network and you will earn rewards reciprocally.

Following “the fresh Blend,” Ethereum’s times application plunged by the regarding the 99.95percent. Please note that way to obtain the products and you may characteristics to the the brand new Crypto.com Application are subject to jurisdictional limitations. Crypto.com may not render specific things, provides and/otherwise features to the Crypto.com Software in a few jurisdictions due to possible otherwise actual regulatory restrictions.

Yet not, this was altered to the Shapella modify inside the April out of 2023, and this gave pages the capability to withdraw their wager gold coins. This is since these Kiln features a group of 40+ advantages overseeing and you may maintaining its nodes. These official designers establish a strong process to familiarize yourself with all signals to avoid one recovery time otherwise slashing. During the early January, the brand new waitlist to have validators seeking log off briefly surged once hit a brick wall crypto lender Celsius established intends to unstake its entire ether holdings. In return for staking their Ether, validators receive a constant rates away from return just like interest money from fixed-money tool such as ties. The fresh graph less than shows that more 13 million ETH is actually currently locked up inside the staking deals, most of it as a result of 3rd-people exploration pools.

In past times week, the new Holesky testnet efficiently current in order to Deneb, a large milestone on the ETH blockchain. Already, the full ETH wager, which is the collective amount of ETH guess by the people, try 38.69 million ETH as of Feb. 11. Ethereum, next-biggest cryptocurrency from the market capitalization, provides exceeded a different staking milestone. StakeWise works an effective system for the node providers, guaranteeing the ceaseless availability and defense from validators to prevent one penalization. With regards to the Cambridge Bitcoin Electricity Use List, the newest annualized energy usage of the newest Bitcoin community is roughly 105 terawatt-days (TWh), over specific nations.

Subsequently, people was able to take part in staking to the network. The ETH, just after wager, might have been locked-up up until following the freshly upgraded blockchain is actually ready to go. Validators is next at random tasked the burden out of verifying purchases, constructing the newest prevents and maintaining the entire features of the blockchain. In return for locking up the ETH, stakers secure a yield paid-in ETH.

When you’re staking with your validator node, it’s now it is possible to to help you unstake the ETH pursuing the Ethereum Shanghai inform, a critical milestone on the network’s change so you can Evidence of Share (PoS). The newest Shanghai inform lets independent stakers in order to withdraw their secured-right up ETH natively to your Ethereum blockchain, unlocking better independence and you can liquidity for ETH proprietors. Ethereum staking involves securing up and taking rewarded recently minted ether cryptocurrency to assist safe and maintain the brand new Ethereum circle. Staking-as-a-solution occurs when your subcontract your own staking rights so you can a 3rd-group company which manages the new validator node and you may staking procedure in your stead, such as a great crypto change otherwise purse.

Enterprise-degrees staking made easy

The new catch is the fact validators who are not legitimate or is actually discovered to be breaking the legislation are penalized insurance firms a good piece or even the totality of the ETH risk removed. We have been a reputable Eu player which have organizations inside the Paris and you can London. Kiln have several designers and transformation operating 24/7 to maintain and screen all of our validators as opposed to interruption. For each customers has a faithful Account and you will Tool director available at any moment.

This procedure away from staking are low-custodial, which means that RockX never ever has entry to the ETH – it is right to the newest blockchain. Really the only slash RockX gets using this is actually 20percent of your own MEV charge, that’s one of many low in the industry. A lot of crypto wallets and you can exchanges service staking-as-a-provider and you will pooled staking. Central crypto transfers offering local ETH staking were Coinbase, MetaMask, and you can Kraken.

Nonetheless, they encompass surrendering particular handle, launching counterparty risk, and you can possibly revealing individually identifying advice (PII) for the provider. Pursuing the button, personal opinion turned into familiar with verify transactions and you can put stops so you can the new blockchain. Validators is now able to share the ETH to participate the new circle, and they are selected randomly to incorporate reduces and secure advantages.

How to Unicamente Risk ETH

Staking Ethereum on the exchanges brings an option for those who can get n’t have the newest technology systems or even the minimal staking count expected to run an independent validator node. Staking swimming pools provides attained stature while the an easily affordable option for anyone trying to venture into crypto staking. These pools aggregate the new resources of several players, letting them combine its staking strength while increasing the alternative away from validating purchases and you will generating benefits. Although not, if you have ever pondered about the ins and outs of staking, our Just how and you will Where you should Share Ethereum guide will likely be best your street. Staking as a result of exchanges is probably the most much easier solution to earn Ethereum staking advantages, but it addittionally requires the extremely believe. Once you put the ETH to a centralized crypto exchange, you must trust that they’re going to take control of your fund responsibly.

A method to Share ETH

PoW consumed huge times, elevating environmental concerns and the overall cost away from keeping the newest Ethereum network. Concurrently, dependence on computational strength minimal the new network’s scalability and you may recommended miners having access to certified resources and you can cheaper power. Centralization from community electricity hindered Ethereum’s ability to handle an evergrowing amount of deals and you can pages. Doing so can help you create wise choices and get away from possibly costly mistakes. Staking will come in of many shapes and sizes, each of these have some other standards, risks and you will advantages. Going for and therefore strategy aligns with your method is vital for individuals who should browse the new ETH staking space safely.

To begin with, release the new Ledger Real time application, hook up your own Ledger device, and you may go to the brand new discover loss. You’ll be able to purchase the amount of ETH you desire to help you risk (keep in mind it must be a simultaneous of 32). Along with, Kiln takes you thanks to all of the needed tips, along with starting your validator background and you will uploading your signing keys. That being said, Unicamente staking for the Ethereum is short for the brand new standard for staking. Even though it includes far more commitments than many other tips, what’s more, it boasts larger benefits.

But not, Lawant detailed the annualized commission give to the gamble ether features shown virtually no upgrade. Validators is actually agencies one share a minimum of 32 Ether inside the the brand new community, enabling these to take part in running Ethereum’s evidence-of-risk consensus blockchain. Becoming a validator—otherwise known as an excellent staker—community participants must lock-up 32 ETH to your blockchain. By implementing proof of risk, professionals state the newest Ethereum blend wil dramatically reduce the new system’s time use from the 99.95percent and increase transaction performance. September scratching the newest arrival out of “the newest blend,” the brand new much time-anticipated modify of one’s Ethereum (ETH) system in order to a verification-of-stake consensus mechanism. The newest trading-of the following is you to definitely centralized company consolidate high pools away from ETH to run large numbers of validators.

Reputation for Staking for the Ethereum

Based on Gartner, enterprise-degrees describes products that add for the structure of at least complexity and gives clear proxy support. If you wish to discover more about how they display screen staking structure in the size, excite take a look blog post. Sooner or later, ETH staking is actually crucial to the growth of the brand new blockchain globe as a whole because encourages decentralisation and prompts innovation and you may robustness of one’s blockchain. It assists to create the fresh blockchain world regarding the proper guidance through it a lot more green and you may decentralised money for hard times out of financing and you may technology. Investors eagerly await confirmation to your whether or not ETH ETFs would be welcome to help you risk coins.